Europe’s Era of Negative-Yielding Debt Is Coming to an End

Paying to hold bonds may be on the way out with Europe's era of negative yields coming to an end.

(Bloomberg) -- Negative yields are becoming an endangered species even in Europe, long the heartland for bonds that you have to pay to hold.

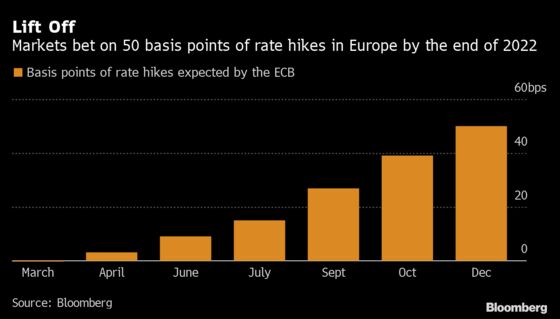

A swathe of yields across the region turned positive in the past week as traders accelerated bets on European Central Bank policy tightening to fight record inflation. Money markets now expect the ECB to lift its deposit rate by 50 basis points in 2022 to take it back to 0% for the first time in almost eight years.

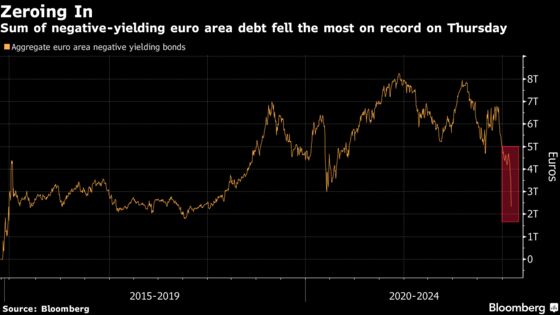

That spurred short-term securities sensitive to ECB policy to plunge further, sending five-year rates on German, Dutch and Swiss bonds well above zero on Friday for the first time in years. With Europe making up around half the world’s total well of sub-zero securities, it’s now the lowest since 2019 and looks set to keep shrinking.

“German two-year yields will soon turn positive,” said Antoine Bouvet, a senior rates strategist at ING Groep NV. “It’s a runaway train with the next stop at 0%, and it signals the era of negative-yielding debt is nearing the end of the line.”

More positive yields should come as a relief to those investors forced in recent years to take on ever more risk in pursuit of returns, from emerging markets to junk debt. Some portfolio managers, including central banks, can only buy positive-yielding securities.

Here’s three charts that show the trend:

The amount of negative-yielding debt tumbled by nearly a third on Thursday alone following the ECB’s meeting, the biggest ever single-day fall. It’s now just a fraction of its record peak above 8 trillion euros ($9.5 trillion) during the pandemic.

The past week’s market moves saw five-year yields across all of Europe’s major economies turn positive. Next to go will be three-year maturities, with only the likes of Germany, France and the Netherlands still negative.

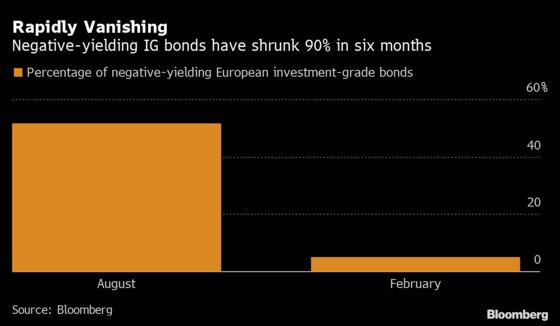

Negative yields are disappearing even more quickly in the world of corporate debt. In the Bloomberg index tracking euro investment-grade bonds, only about 5% now yield less than zero, down from over 50% just six months ago.

The average yield on the index is heading toward 1% for the first time since mid-2020. While the moves are weighing heavily on total returns, which are negative this year, the higher yields may help lure new buyers.

“At the peak of negative-yielding debt last year, some IG sectors were uninvestible as they contained far more negative bonds than positive ones,” Bank of America Corp. strategists led by Barnaby Martin wrote in a note, pointing to retail, tech and autos. “Accordingly, demand for these sectors may return as negative rates disappear.”

Next Week

There is a large slate of central bank speeches next week that investors will turn to for guidance, including appearances from the ECB’s President Christine Lagarde, plus Klaas Knot and Francois Villeroy. Comments by BOE Governor Andrew Bailey and chief economist Huw Pill will also be in focus for any clues on the pace of policy tightening.

- Bond sales from Germany, Italy and Portugal are expected to total about 11 billion euros, according to Commerzbank AG. The EU is seen selling debt via banks next week, according to Danske Bank A/S, which anticipates a tenor longer than 25 years to raise as much as 8 billion euros. The U.K. is expected to syndicate a new 50-year offering.

- Economic figures in the euro area and Germany are mostly second-tier and backward looking, while the U.K. publishes fourth-quarter growth data.

©2022 Bloomberg L.P.