As home sales in the Greater Toronto Area (GTA) continue to outpace new listings, the Toronto Regional Real Estate Board (TRREB) has revised its 2021 sales forecast and average listing price, with the expectation that they will both rise even higher -- to record levels.

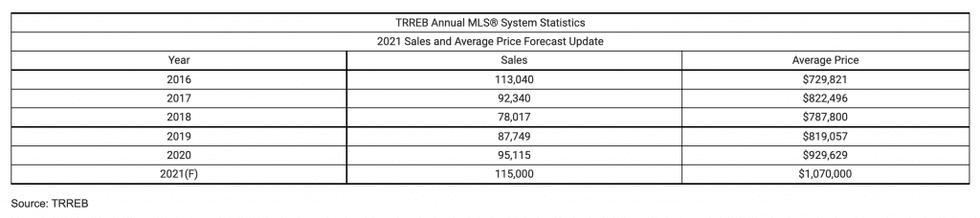

TRREB released its initial forecast for 2021 at the beginning of February in conjunction with its annual Market Year in Review and Outlook report. The outlook for 2021 called for 105,000 transactions with an average selling price of $1,025,000.

The board says this forecast was released as the regional economy continued to improve, and very low borrowing costs were anticipated to continue to fuel strong demand -- though this demand was expected to slow during the year due to stalled population growth.

Although the board says sales have peaked for 2021, first-quarter activity was higher than expected, after March home sales, at more than 15,000, represented an all-time monthly record.

READ: CMHC Admits Mistake, Reverses Changes Made to Mortgage Underwriting Practices

Considering the record Q1-2021 sales result, TRREB has revised its 2021 sales forecast and anticipates the year will end with 115,000 transactions -- 10,000 more than it originally forecast. With year-over-year sales growth continuing to outpace new listings growth, the forecast average selling price has also been revised upward to $1,070,000, a $45,000 increase.

“Home sales soared at the start of the year, with a huge sales record in the first quarter. However, the record pace of sales has run its course as pent-up demand has increasingly been satisfied in the absence of normal population growth," said TRREB Chief Market Analyst Jason Mercer.

"With this said, a persistent lack of inventory across most segments of the market will keep competition between buyers strong, resulting in an average selling price well above $1 million through the end of 2021,” said Mercer.

TRREB’s revised market update comes as new public opinion polling, conducted by Ipsos Public Affairs for TRREB, found public opposition to a potential increase in Toronto’s Municipal Land Transfer Tax (MLTT).

Last winter, City of Toronto Council directed City staff to report back in July regarding a possible increase to the land transfer tax for properties priced over $2 million.

“Any MLTT increase has a ripple effect on all market segments, and would further constrain inventory, making it an even more challenging environment for buyers. Recent polling by Ipsos shows a majority of residents understand this risk and more than half oppose a potential increase to the land transfer tax. Housing affordability is one of Toronto’s most serious challenges and City Council should be doing everything it can to make it more affordable, not less,” said TRREB CEO John DiMichele.

The board has previously said it had concerns about the potential tax increase. As DiMichele reiterated, not only could it further constrain the supply of homes for sale in Toronto, but it could also exacerbate housing supply and affordability challenges, especially for those purchasing modest homes.

The poll found more than half (54%) of respondents are against this potential MLTT hike, while 63% said they believe the increase could result in a tighter supply of homes for sale across all price points.

Additionally, the new forecast comes as Toronto moves towards implementing a tax on vacant homes, excluding principal residences. TRREB says it has worked closely with City staff, calling for evidence-based decision-making to ensure that the tax meets its policy objectives of improving rental housing supply and ensuring that appropriate exemptions are provided.

“We appreciated the opportunity for input, and we are encouraged that the recommended tax design is consistent with TRREB’s views, especially the need for various exemptions," said DiMichele.

"TRREB is generally supportive of the list of exemptions included in the staff recommendations, and we look forward to providing further input as staff continues with the next step of public consultations,” added DiMichele.