Pandemic Pay Plunder

Low-Wage Workers Lost Hours, Jobs, and Lives. Their Employers Bent the Rules — To Pump up CEO Paychecks.

Sarah Anderson | Sam Pizzigati

Introduction

In 2008, executives chasing after huge paydays crashed the U.S. economy. That crisis left millions of Americans homeless and jobless. Today, we’re living through a period of even greater national suffering.

Over the course of the pandemic, our frontline workers have repeatedly proven how absolutely essential their work remains. And yet, as we document in this 27th annual Institute for Policy Studies Executive Excess report, corporate boards are performing cartwheels to protect huge paychecks at the top of our corporate hierarchies.

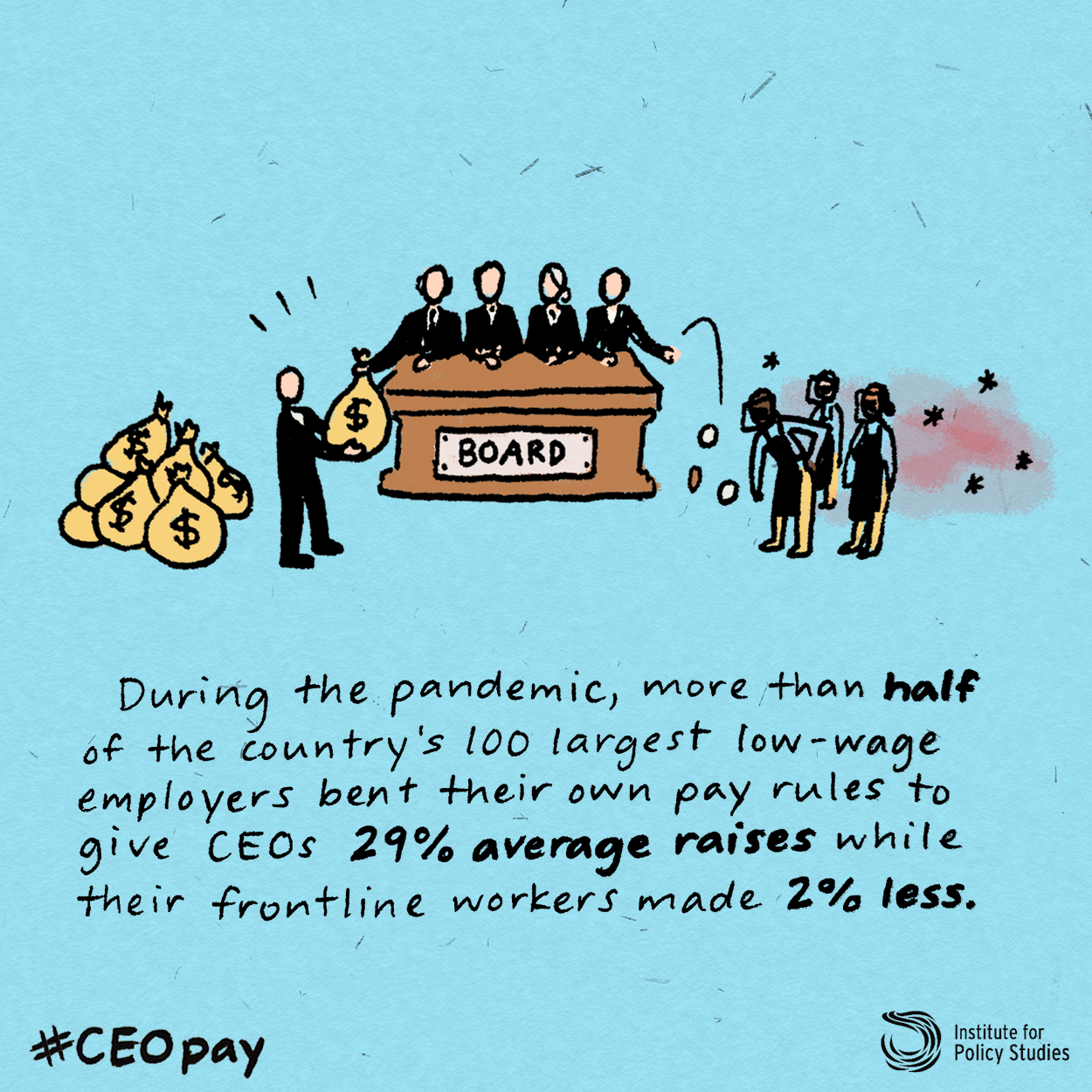

Over half of America’s largest low-wage employers, we found, bent the rules to boost CEO pay last year — even as essential workers took the biggest risks to keep the economy running.

This kind of greed left working families much more vulnerable even before the COVID-19 crisis, with nearly 40 percent of Americans unable to afford a $400 emergency. During the pandemic itself, it spelled catastrophe for ordinary families.

Meanwhile, corporate chief executives in the United States have continued to score the sorts of windfalls that have ballooned billionaire wealth by over $1 trillion since the pandemic began. Our corporate compensation practices have, in effect, delivered prosperity for the few and precarity for the many.

We need a new model for American business. Tax incentives and other policy measures could help create it.

Key Findings

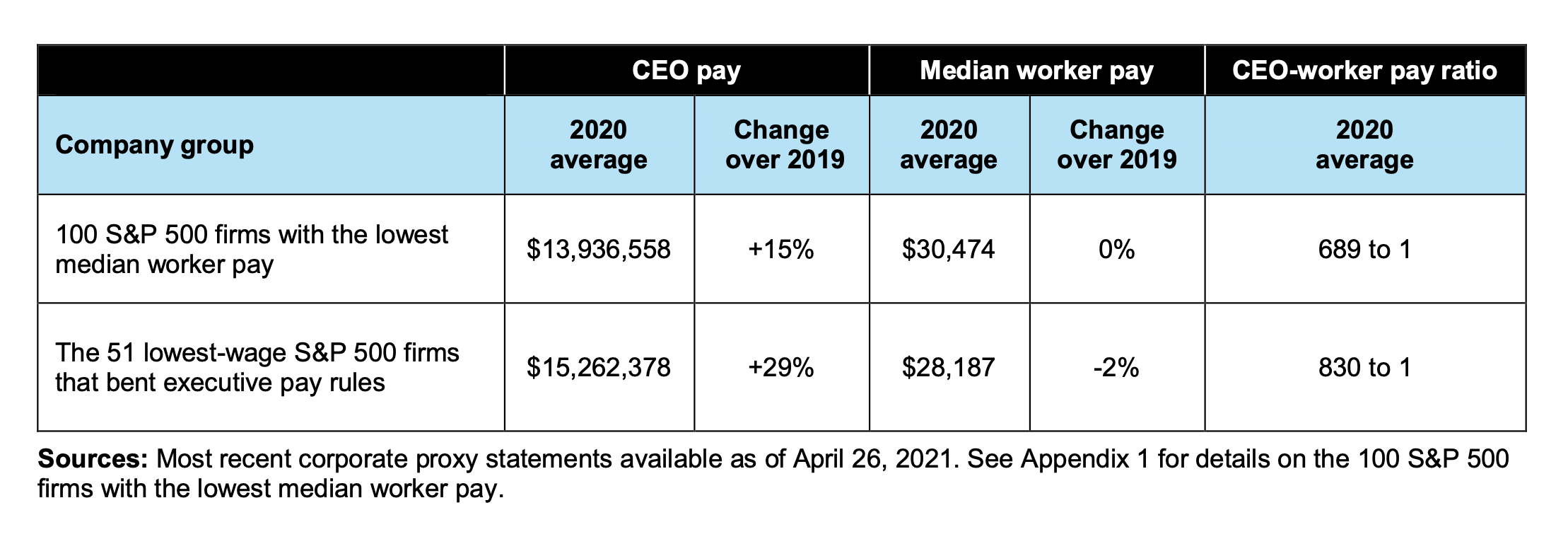

- Of the 100 S&P 500 firms with the lowest median worker wages, 51 bent their own rules in 2020 to pump up executive paychecks.

- Common manipulations included lowering performance bars to help executives meet bonus targets, awarding special “retention” bonuses, excluding poor second-quarter results from evaluations, and replacing performance-based pay with time-based awards.

- Among those 51 companies:

- CEO compensation averaged $15.3 million, up 29 percent from 2019.

- CEO-worker pay ratios averaged 830 to 1 in 2020.

- Median worker pay ran $28,187 on average in 2020, 2 percent lower than in 2019.

- Sixteen firms ended 2020 in the red. This group of profit-losing, rule-bending corporations had the highest average CEO pay, at $17.5 million.

- Because women and people of color make up a large share of low-wage workers and a tiny share of corporate leaders, extreme CEO-worker pay divides increase gender and racial disparities.

- Extreme pay divides also decrease organizational effectiveness. Decades of studies back up Treasury Secretary Janet Yellen’s 1990 “Fair Wage-Effort Theory” that large pay disparities undermine employee morale and productivity.

The pandemic has brutalized low-wage workers, particularly workers of color. These employees suffered 2020’s highest job loss rates. They also suffered the highest COVID-19 infection rates.

While these workers suffered, a majority of large low-wage employers responded by boosting their executive pay. Despite the pandemic economic crisis, the Wall Street Journal projects that CEO pay at major U.S. corporations will likely end up hitting record highs.

Of the 100 S&P 500 corporations with the lowest median worker pay, 51 bent their own rules to pump up executive paychecks. These 51 firms awarded CEOs bigger paychecks and typical workers smaller ones than their counterparts at other low-wage S&P 500 firms.

The 100 S&P 500 corporations we analyzed all paid median compensation under $50,000 in 2020. Some did offer frontline employees paid leave and small pay increases during the pandemic, usually around $2 per hour, but in nearly all cases this modest extra COVID-19 support was only temporary. The real largesse flowed only to C-suites.

Carnival

Carnival, the world’s largest cruise operator, secured $6 billion in low-cost financing in April 2020, thanks to a Federal Reserve lifeline. But as of August, the company still had some employees stuck on ships.

That same month, the company’s board awarded CEO Arnold Donald special pandemic “retention and incentive” stock grants valued at more than $5 million.

Arnold’s total 2020 compensation came to $13.3 million — 490 times more than the company’s median worker pay of just $27,151.

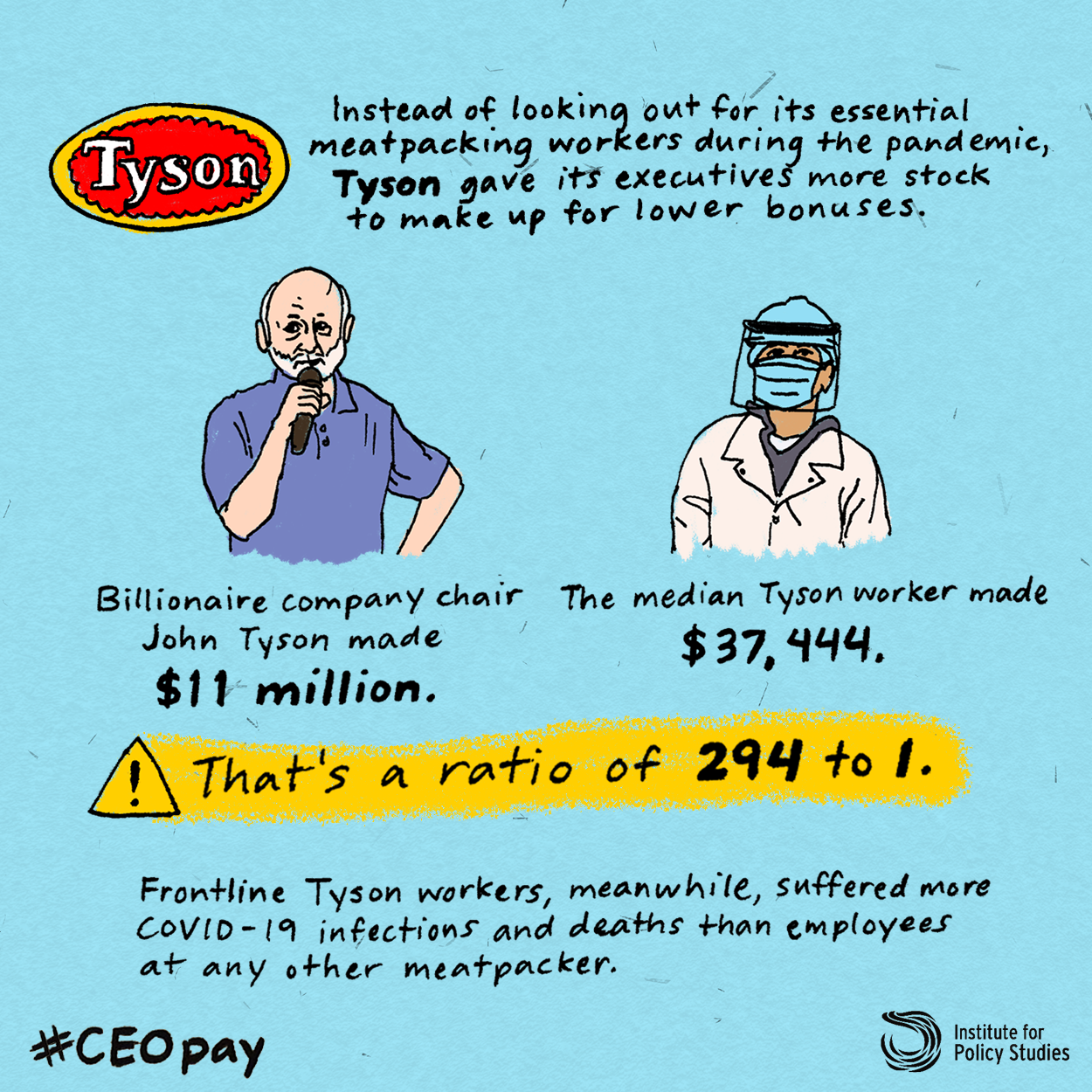

Tyson Foods

When executives didn’t meet their cash bonus targets, Tyson Foods board members gave them stock awards to make up the difference.

CEO Noel White wound up with total compensation of nearly $11 million — 294 times as much as typical worker pay of $37,444. John Tyson, the heir and grandson of the company founder, watched his personal wealth increase 72 percent during the pandemic — to $2.6 billion.

Frontline Tyson employees, meanwhile, suffered more COVID-19 infections and deaths than those at any other meatpacker. More than 12,000 Tyson workers have been infected by the virus and at least 38 have lost their lives to it.

Hilton Worldwide

Hilton CEO Christopher J. Nassetta saw his 2020 compensation package come to $55.9 million — the highest among the 100 S&P 500 firms with the lowest median wages.

After Nassetta failed to meet his performance goals, the Hilton board inflated his paycheck by “modifying” restricted stock awards.

Meanwhile, Hilton slashed their global workforce from 173,000 to 141,000. The CEO’s paycheck came to 1,953 times as much as the company’s median worker pay of $28,608.

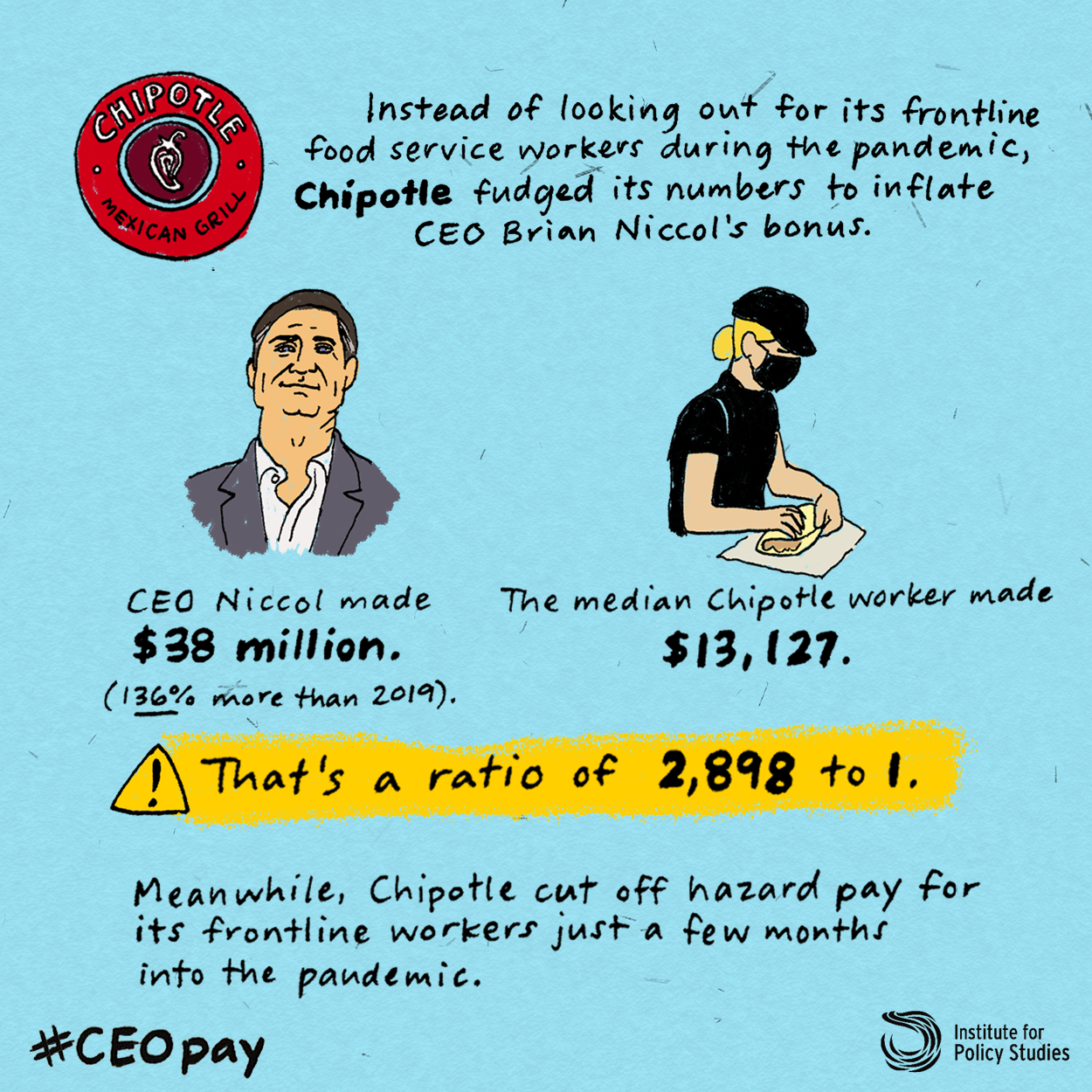

Chipotle Mexican Grill

Chipotle CEO Brian R. Niccol made $38 million in 2020 — a 136 percent raise over his 2019 compensation. The board inflated his bonus by tossing out its poor financial results from the shutdown and excluding some COVID-19-related costs from his performance evaluation.

Niccol made 2,898 times as much as the company’s median worker pay of $13,127.

Aptiv

Aptiv PLC — formerly Delphi Automotive — had the widest pay gap in the S&P 500 in 2020. Chief executive Kevin Clark’s compensation is valued at $31.3 million — 5,294 times as much as the company’s median worker pay of $5,906.

The Aptiv board inflated Clark’s paycheck through an “update” of annual bonus metrics and by shortening the performance period for long-term executive incentive awards to exclude 2020.

YUM Brands

In March 2020, the owner of KFC, Pizza Hut, and Taco Bell announced that CEO David Gibbs would donate $900,000 of his salary to pay for $1,000 bonuses for restaurant general managers. But the board changed its bonus metrics to give Gibbs a $1.4 million cash bonus and a stock grant valued at $882,127.

His special COVID-19 bonuses totaled more than 2.5 times his voluntary salary cut. This largesse boosted Gibbs’s total compensation to $14.6 million — 1,286 times as much as median worker pay of $11,377.

The fast food giant did not offer hazard pay to these frontline employees, whose average wages are just $9.75 per hour, according to Payscale.

Dollar Tree

After the discount retailer’s executives failed to meet their 2020 bonus targets, the Dollar Tree board awarded them restricted stock grants with approximately the same value.

For new CEO Michael Witynski, who spent less than six months in the top post in 2020, this translated into a bonus valued at about $1.5 million, boosting his total compensation to $11.3 million.

That’s 715 times as much as the pay for the company’ median worker, a part-time U.S. store employee who earned $15,816.

Coca-Cola

None of the soft drink maker’s top executives met their bonus targets last year, but the Coca-Cola board gave them all bonuses anyway.

For CEO James Quincey, that $960,000 bonus, combined with new stock-based awards, drove his total compensation package above $18 million, over 1,600 times as much as the company’s typical worker pay.

In December 2020, Coca-Cola announced plans to cut about 2,200 jobs, or 17 percent of its workforce. Coke profits dropped by 13 percent last year. About 1,200 of the layoffs will hit U.S. workers.

Darden Restaurants

After the pandemic shuttered Olive Garden and Darden’s other full-service restaurant chains, CEO Eugene I. Lee, Jr. gave up most of his base salary, resulting in a $170,240 reduction for the company’s 2020 fiscal year.

But even though Lee didn’t meet his performance goals, the board modified its metrics and handed him a $1.9 million payout anyway. That maneuver inflated his total compensation to $8.7 million — 538 times as much as median worker pay of $16,137.

Darden is a leading opponent of raising the subminimum tipped wage, which has remained stuck at $2.13 per hour for more than 20 years. The advocacy group One Fair Wage has just filed a lawsuit against Darden, alleging their tipped wage practices increase sexual harassment and widen racial and gender income gaps.

Johnson Controls

Johnson Controls CEO George R. Oliver agreed to trim his 2020 base salary by a little over $150,000 in 2020, but his board more than made up for that gesture by manipulating metrics to increase his cash bonus to more than $2 million. His total compensation came to $13.7 million — 357 times more than median worker pay of $38,462.

While Johnson Controls claims it did not reduce employee salaries in 2020, it is in the process of cutting 6,500 jobs.

Taxing extreme pay gaps could generate significant revenue for a more equitable COVID recovery. The Tax Excessive CEO Pay Act would incentivize corporations to narrow their divides through graduated tax rate increases based on the size of their pay gaps. Corporations with pay gaps between a company’s highest-paid executive and median worker of less than 50 to 1 would owe no extra taxes under this bill. The largest tax increase, of five percentage points, would apply to pay ratios of more than 500 to 1. If this bill had been in place in 2020:

- Walmart, with a pay gap of 1,078, would’ve owed an extra $1 billion in federal taxes, enough to cover the cost of 13,502 clean energy jobs for a year.

- Amazon, with a pay ratio of 1,596 between highest-paid executive (David H. Clark, CEO of Worldwide Consumer, with $46.3 million) and median pay, also would’ve owed an extra $1 billion, enough to pay for 115,089 public housing units for a year.

- Home Depot, with a 551-to-1 gap, would’ve owed an extra $800 million, enough to create 18,329 jobs that pay $15 per hour with benefits for a year.

Support for reining in extreme pay gaps is also growing at the state and local levels.

San Francisco voters overwhelmingly passed a ballot initiative in 2020 to become the second city in the United States to impose a tax penalty on corporations with extreme divides. The nation’s first pay-ratio tax went into effect in 2018 in Portland, Oregon.

In nine state legislatures, policymakers have introduced similar proposals to discourage excessive executive pay and encourage higher compensation for ordinary workers.

The report also includes a comprehensive catalog of additional policy options for reining in CEO pay.

SOCIAL TOOLKIT

For sample social media posts you can use to help promote the report, check out our Executive Excess 2021 Social Toolkit, which includes download links to social graphics in Twitter and Instagram/Facebook dimensions.

Download the Press Release [PDF]

Media Contacts:

Sarah Anderson, sarah@ips-dc.org

Olivia Alperstein, olivia@ips-dc.org, (202) 704-9011

Bob Keener, bobk@ips-dc.org, (617) 610-6766