It’s official … The market’s got a trillion-dollar club.

Wanna know how insanely rich the world’s largest companies are?

They have more cash in the bank than the GDP of many nations. They’ve created some of the world’s richest people, and you’ve probably used one or more of their products very recently.

And, perhaps the greatest thing, you can trade their stocks every day. Or you can ride on their success just like we do in StocksToTrade Pro.

This post is all about the world-dominating, society-changing, trillion-dollar companies. Let’s dive right in!

Table of Contents

What Is a Trillion-Dollar Company?

Before we answer that, let’s go over a few key terms…

The first is market capitalization, often referred to as market cap. That’s the total value of a company’s shares.

For example, a company might have a million shares outstanding, and the price of each share is currently $10. To determine the market cap, we multiply the number of shares outstanding by the price of each share:

1,000,000 shares x $10 = $10,000,000

This company has a market cap of $10 million.

The second term you need to understand is the value of a trillion. A trillion is one thousand times one billion. Here it is in numerical form: 1,000,000,000,000. Huge number, right?

So, what’s a trillion-dollar company? It’s simply a company that has a market cap of $1 trillion or more.

Let’s get some perspective … Think of the Ford Motor Company (NYSE: F). It’s been making cars since 1903. It’s a huge, world-famous firm, selling cars across the globe.

Would you be shocked if I told you that Ford’s market cap is $32 billion — just 3.2% of one trillion dollars?

To put it another way, a trillion-dollar company is at minimum 30 times larger than the Ford Motor Company. Hopefully, you’re starting to grasp just how enormous these trillion-dollar companies are.

With the stock market’s longest bull run in history, we’ve now got more trillion-dollar companies than ever. In the U.S. alone, that’s four to be exact.

Let’s look at these monumentally huge companies…

Why Trillion-Dollar Companies Matter

Maybe you’re wondering what the big deal is … Why does a company surpassing a trillion dollars of market-cap mean anything — it’s just a number, right?

It’s true that a trillion is just a number. It also happens to be the bellwether to measure the economy’s largest companies against.

By knowing which firms are in the trillionaire club, we can see which sectors and companies are most dominant.

America’s trillion-dollar firms are in the tech sector. That seems pretty standard since we’re in the information age. In other eras, railroad companies, oil companies, or steel firms would’ve been the top-dog stocks in the market.

America’s Trillion-Dollar Companies

American trillion-dollar companies are a recent phenomenon. We saw the first stock to reach this massive milestone a few years ago in 2018.

Since then, we’ve seen three other companies jump the trillion-dollar barrier. There were four trillionaire firms, but at the time of this writing the market knocked two off the official list. Will these giants reclaim trillionaire status? It’s worth watching … And there could be more on the horizon.

Here’s a breakdown of the trillion-dollar club…

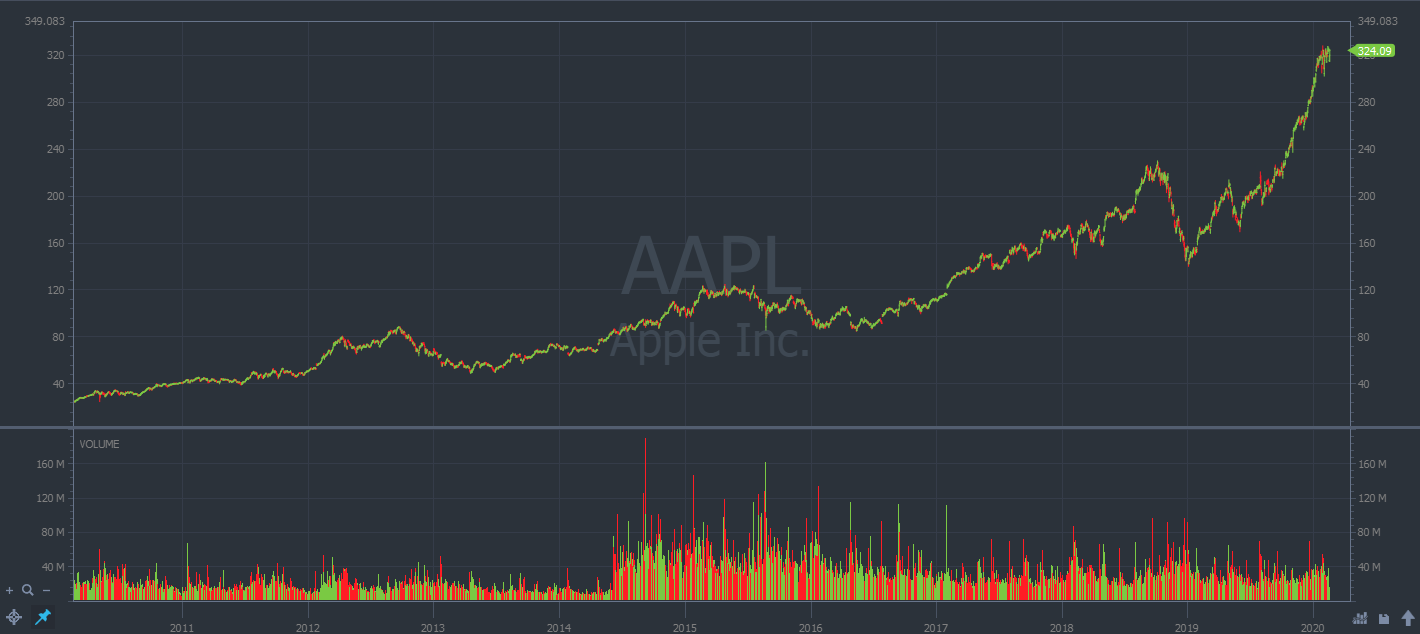

Apple Inc. (NASDAQ: AAPL)

Market Cap: $1.27 trillion

Revenue: $266 billion

Employees: 104,000

Steve Jobs and Steve Wozniak started Apple in 1976 in a garage in California. The company became a major player at the dawn of the personal computer age in the 1980s.

The company had its initial public offering IPO on December 12, 1980, at $22 per share. There was a ton of hype around the stock. The first trading day saw the stock go over $29 per share. That gave the company a market cap of around $1.78 billion.

Since its IPO, Apple’s rise to trillionaire status hasn’t been drama free. The company ran into huge financial troubles in the 90s. There were product failures and overblown research and development costs. At times there was a general lack of company direction.

When Jobs returned to Apple in 1997, his fresh direction for the company set it on an arc for prominence once again. The 2000s and beyond saw milestone Apple products — iMac, iPod, iTunes, iPad, MacBook. And, of course, there’s the iPhone and the development of the smartphone.

Today, Apple products are in huge demand across the globe. They’re not just known as high-end tech products — but also akin to high-end luxury products. That allows the company to set higher prices than rival firms.

Apple initially became a trillion-dollar company on August 4, 2018. It currently has a market cap of $1.27 trillion.

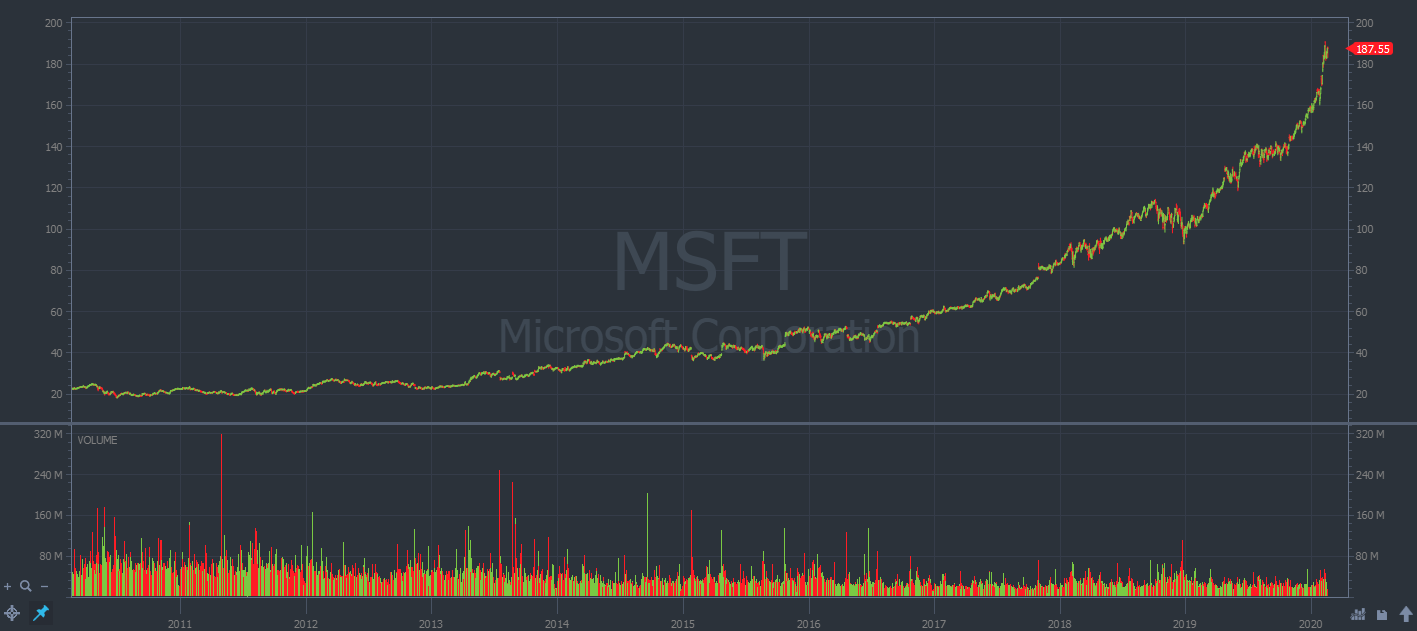

Microsoft Corporation (NASDAQ: MSFT)

Market Cap: $1.29 trillion

Revenue: $110 billion

Employees: 144,000

Microsoft was founded by Bill Gates and Paul Allen in 1975 as a small software firm. Through the famously crafty business dealings of Gates, the firm eventually went on to create operating systems vital to the booming personal computer market.

Microsoft’s IPO was on March 13, 1986, for $21. By the end of the first trading day, the market pushed the price up to $27.75.

Microsoft’s gone on to become a tech conglomerate. It’s developed a huge array of computer software and hardware devices. The company’s so dominant that Bill Gates has consistently been one of the top five wealthiest people in the world for decades. He often grabs the top spot.

Microsoft joined the trillion-dollar club on June 7, 2019. The price action since then has remained bullish. The market cap is up to $1.29 trillion as of this writing.

Amazon.com Inc. (NASDAQ: AMZN)

Market Cap: $982 billion

Revenue: $233 billion

Employees: 648,000

Who would’ve guessed that a member of the trillion-dollar club would start as an online bookstore? Jeff Bezos founded the company in 1994. After finding success in the book industry, the company gradually expanded to sell a wide range of products as well as cloud-computing and digital-streaming services.

Amazon went public on May 15, 1997, for a price of $18 per share. Its shares reached as high as $30 on its first trading day. At the time of the IPO, the company’s market cap was just north of $400 million.

Over the years, Amazon has expanded globally. So many of us are used to shopping on Amazon as a routine part of our lives. The company’s so entrenched in modern life that it’s propelled Bezos to the status of the world’s richest person — his current net worth is over $130 billion.

Amazon became the second company to break the trillion-dollar barrier when it crossed the line on September 4, 2018. It stayed in the club until the coronavirus sell-off in February.

Can Amazon quickly rejoin the trillion-dollar club? Let’s just say it’s historically been a bad idea to bet against the firm…

Alphabet Inc. (NASDAQ: GOOGL)

Market Cap: $952 billion

Revenue: $137 billion

Employees: 114,000

Don’t recognize Alphabet Incorporated as easily as the other companies on this list? That’s because it’s better known as Google. The name Alphabet came along in 2015 and refers to Google’s parent company. Google is technically a subsidiary of Alphabet.

Google was founded in September 1998 by two Stanford Ph.D. students — Larry Page and Sergey Brin. The company initially developed powerful search engine software. It quickly became the most widely used search engine on the planet.

The company grew rapidly by developing new product lines and acquiring smaller tech firms. Google’s product lines are almost endless … office software, mobile operating software, cloud storage, mapping devices … It even owns YouTube.

On August 19, 2004, the company’s IPO started with a price of $85. Shares rocketed up to over $100 on the first day.

Google was the latest firm to join the trillion-dollar club … The company jumped over the line earlier this year, on January 16. It’s all exciting, right? This growth is huge.

But there are headwinds … The recent coronavirus-related market scare knocked Google’s price back down. Can the search giant rejoin the trillion-dollar club? Let’s wait and see…

Lessons From America’s Trillion-Dollar Companies

Examining the trillion-dollar firms can teach us a number of lessons about modern society. Plus we can learn more about the current state of the business world and today’s stock market.

Here are a few lessons and observations from the trillion-dollar club…

#1 They’re All Tech Firms

I don’t think anyone can deny that we’re living in the information age. Modern society runs on high-tech devices, broadband connections, instant communications, and big data.

The tech firms clearly rule the current era. We need to keep that in mind when picking hot sectors and stocks.

#2 They Often Grow By Acquiring Small Firms

Every trillion-dollar firm is famous for buying up small tech-firms when they want to focus on new market segments. For example, Google didn’t create Adwords or YouTube. Those were the inventions of smaller firms that Google acquired.

That’s smart to remember when trading stocks of smaller companies that could be potential acquisitions for larger tech companies. A buy-out offer can often be a great thing when you’re holding a stock. But if you’re shorting that stock, that news is horrible (and can cost you big).

#3 They Might Be Too Big Already

There’s a lot of news in recent years that these major tech firms are too large.

Many believe that companies like Google, Amazon, and Facebook are monopolies. They’re deeply ingrained in our society. They collect huge amounts of data and make it hard for other firms to compete.

The argument is that these giants dominate rather than serve the general population.

In the past, the government has stepped in with antitrust laws to break up monopolies. The goal is to encourage competition and protect the consumer.

Studies show that two-thirds of Americans support measures to decrease the prominence of major tech firms in modern society. This kind of political rhetoric — and its ripples in the market — should be interesting to watch in the coming years.

The Richest Companies Throughout History

The trillion-dollar club companies seem huge, right? But when you account for inflation companies from previous eras were actually larger.

Here’s a breakdown of the three largest companies historically…

The Dutch East India Company (Adjusted Market Cap: $8.28 Trillion)

The Dutch East India Company was founded by the Dutch Government in 1602 to form a shipping and trading megacorporation.

The creation of the company brought together a group of rival Dutch trading companies. That was to conduct international trade with India and Southeast Asian countries.

In those days, spices, silk, rice, and soybeans were precious and in-demand products. The company also had a huge network of shipbuilders, docks, and other assets.

The Dutch East India Company pioneered many of the activities of corporations that we still see to this day. For instance, it was one of the earliest firms to issue shares and bonds to the general public.

It’s believed that at one point the company was worth about $8.28 trillion in today’s dollars — dwarfing today’s trillion-dollar firms.

The Mississippi Company (Adjusted Market Cap: $6.8 Trillion)

The Mississippi Company was a land-holding company in the 1700s. It held a huge amount of land in French colonies in Mississippi and the West Indies.

The company was created in France and was a key component in one of the most famous historical financial bubbles of all time: the Mississippi bubble.

This bubble came about through a twisted network of French royalty, private bankers, the French public and a famous economist. There was wild speculation over the value of the land the company held in Mississippi.

It was all largely a scam. There was exaggerated marketing, public mania, and news hype … Not unlike what we see in today’s stocks, especially penny stocks…

At the height of the bubble, the market cap is said to have been around $6.8 trillion by today’s standards.

Which Company Could Join the Trillionaire Club Next?

Is it your goal to invest in a company and ride its stock until it joins the trillion-dollar club? Unfortunately, you missed the boat on Apple, Microsoft, and the others on the list.

But don’t despair! One of the best things in the stock market is the hunt. It’s all about finding that next big runner. That means you gotta be prepared. So it’s a good idea to look for the next trillion-dollar company now.

Which companies are next in line? Think large, established firms currently worth at least a few hundred billion dollars. Here are a few to watch…

Facebook Inc. (NASDAQ: FB)

Current Market Cap: $562 billion

All the other major tech firms are in the club already … So you might expect that Facebook will eventually find its way there.

In 2019, the value of this social media company almost doubled. But scandals over its management of user data slowed it down. The government could crack down hard on the firm — it’s worth watching for the drama alone.

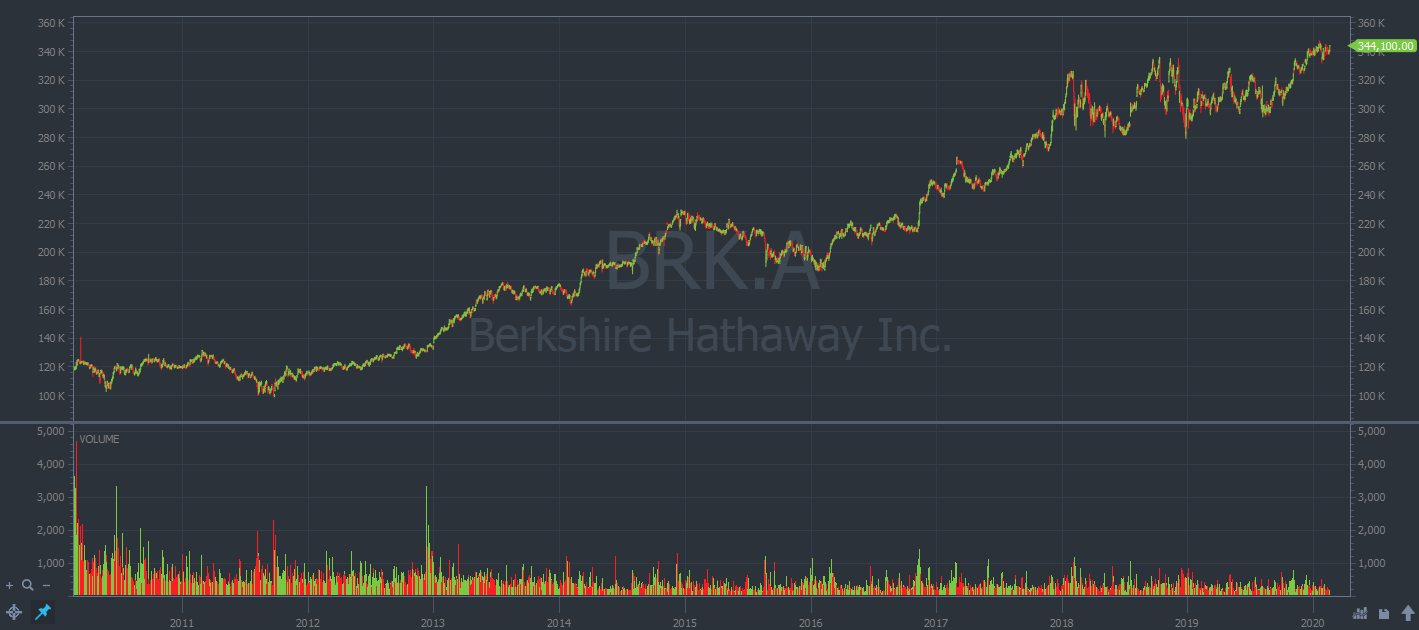

Berkshire Hathaway (NYSE: BRK.A)

Current Market Cap: $530 billion

Berkshire Hathaway is not a tech firm. It’s the conglomerate run by world-famous value investor Warren Buffett. The company owns all kinds of businesses — from insurance to furniture to Coca Cola to Dairy Queen.

Conglomerates like Berkshire often can’t achieve the blistering fast growth rate of a tech firm … But Warren may have a few tricks left up his sleeve. Currently, he’s sitting on a cash pile of over $100 billion.

Some speculate he’s planning to aggressively buy discounted stocks and companies if the market has a major decline.

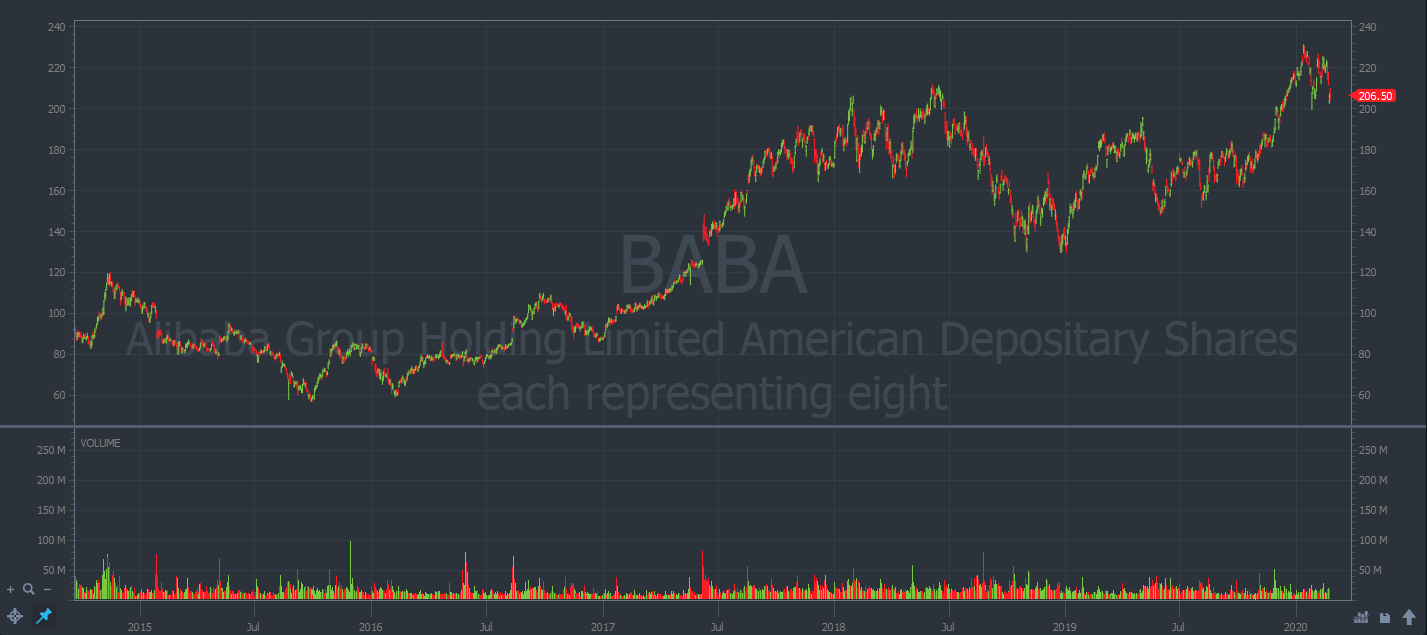

Alibaba Group (NYSE: BABA)

Current Market Cap: $561 billion

If you want to trade major tech names, smaller tickers, or even tiny, ultra-volatile penny stocks, StocksToTrade is the tool you need to have.

StocksToTrade is the trading and analysis platform we created to fulfill the needs of real-world, everyday traders.

How do we know what real-world traders need? Because we’re real-world traders, not marketers or accountants trying to push a product.

StocksToTrade is finely tweaked to offer a more streamlined trading experience. We want to help you get the best out of every trading day.

You can find just about everything you could need to analyze, trade, and manage a stock position in the one program:

- Charts

- Scanners

- Newsfeeds

- SEC filing

- Social media buzz

- Algorithmic trading support

- Watchlists…

- And so much more.

It’s no accident that many of the world’s best traders use our platform every day. See why with a 14-day trial for just $7!

The Trillion-Dollar Conclusion

The market is booming — we now have four different American companies worth more than a trillion dollars each.

The big question: what does that mean for the average retail trader?

Some traders and investors will look for opportunities with big trillion-dollar firms. Others will look for smaller stocks that the larger firms want to acquire. Some will look for tickers that could make big price runs to join the trillion-dollar club.

Personally, I’ll stick to what I know best and where there’s the most volatility: penny stocks.

With penny stocks, I can trade the hype surrounding tech and trillion-dollar stocks. I can also ride huge price waves of 10%, 20%, 50% or more.

And I can do it all in a single trading day. A market cap of trillion dollars or more is impressive, but these companies don’t make these kinds of moves.

See how I approach the market every day. Come and join me in the StocksToTrade Pro community.

We’re about trading smarter and market education every single day. You’ll see my screens and hear my market commentary. Plus, you can participate in trading chat rooms, attend training webinars, and so much more. Come join us!

Which company do you think will be next to have a market cap of a trillion or more? Tell me below!