German Yields Cross Zero Threshold as Bond Selloff Intensifies

German 10-Year Yield Turns Positive for First Time Since 2019

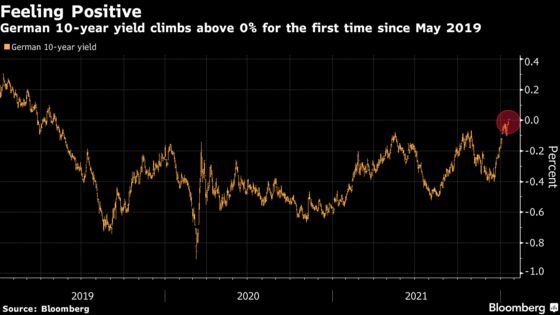

(Bloomberg) -- Benchmark German debt yields climbed above zero for the first time since before the pandemic as investors braced for central banks to scale back monetary stimulus in the face of accelerating inflation.

The rate on 10-year bunds rose as much as four basis points to 0.02%, crossing into positive territory for the first time since May 2019. It comes as money markets bet the European Central Bank will start raising rates in September from October previously. Traders expect that by the end of next year, the policy rate will no longer be negative.

It’s a milestone for European investors who have had to grapple with negative-yielding debt for years and a headwind for governments in the region that face the prospect of rising borrowing costs. The 10-year German yield has been submerged below zero since early 2019. It fell to as low as -0.91% around the height of coronavirus panic in March 2020, weighed down by the ECB’s bond purchases and liquidity injections.

But a surge in inflation as economies begin to recover is now taking its toll, with traders weighing the prospect of tighter central bank policy and ramping up bets on further bond declines. The sum of negative-yielding German bonds fell below 1.5 trillion euros ($1.7 trillion) for the first time in two years on Monday, while the global total is now half its 2020 peak, at $9.12 trillion.

“Investors are very cautious that this year the ECB is less accommodative,” said Althea Spinozzi, fixed income strategist at Saxo Bank A/S on Bloomberg Television on Wednesday. “At that point, bund yields will need to rise well above that 0% mark and that is trouble for other European sovereigns, especially those with a high beta such as Italy.”

The three-month euro funding rate climbed to minus 0.557%, the highest since October. Just five weeks ago it had slipped to a record low, and reflects how fast tightening wagers are being repriced. The market sees the ECB delivering a 10-basis-point increase in September, taking the key rate minus 0.4%.

The rise in German yields mirrors a global move led by Treasuries. Speculation is growing that the Federal Reserve will respond to rampant inflation by delivering a half-percentage point increase in March, which would be its first since 2000.

“Positive yields are here to stay,” said Antoine Bouvet, a rates strategist at ING Groep NV. “It’s a brand new world.”

©2022 Bloomberg L.P.