The ECB’s Inflation Dashboard Is Getting Trickier to Interpret

One of the ECB’s inflation cues for raising interest rates is becoming harder to read, complicating the already tricky task.

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

One of the European Central Bank’s inflation cues for raising interest rates is becoming harder to read, complicating the already tricky task of deciding when to tighten monetary policy amid the fallout of the war in Ukraine.

ECB decision-making hinges in part on so-called underlying price trends, which policy makers track through several measures that remove volatile components like food and energy. But the knock-on effects of logistical snarls and soaring oil and gas costs may be pushing those indicators too high, distorting the picture they’re meant to clarify.

That’s what Chief Economist Philip Lane signaled in a recent speech, suggesting the gauges may at present be too unreliable as a policy prompt. Alongside the threat to economic growth from Russia’s invasion, such a conclusion could reduce the chances of a rate hike in 2022 -- even with headline inflation almost three times the 2% official goal.

“It’s genuinely difficult to fully get a grip on what’s going on in the data” but Lane “does have a point,” said Nick Kounis, head of macro and financial-market research at ABN Amro. “Supply-side and energy-driven inflation -- unlike the wage-driven type -- squeezes purchasing power, arguably sowing the seeds of its own downfall” as elevated prices curb demand and slow the economy.

Euro-zone growth will take a hit of 0.3 to 0.4 percentage point this year, the ECB predicted in the immediate aftermath of Russia’s invasion. While officials promise to act based on incoming data, they also say a gradual removal of stimulus remains the most appropriate plan.

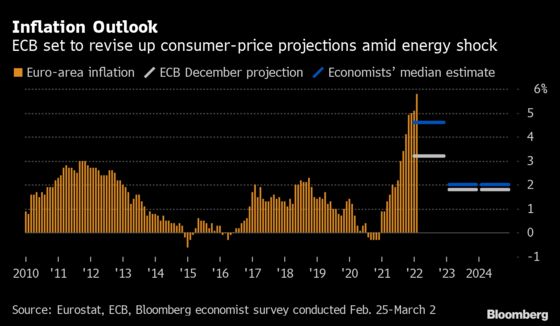

Fresh forecasts due when the ECB meets this week are likely to show prices growing sustainably and in line with the 2% official target following this year’s record surge. Lane, who makes policy proposals during Governing Council meetings, is cautious on jumping the gun.

Core inflation hit a record 2.7% in February. Even a measure for services -- Bloomberg Economics’s favored gauge for domestic pressures -- shows businesses raising prices at the fastest pace in a decade when adjusted for pandemic disruptions. The ECB’s preferred measure of inflation expectations reached a nine-year of 2.4% on Tuesday.

Whether those gains, which are connected to energy and supply bottlenecks, will reverse or bring a sustainable inflation boost depends mostly on wages, according to Maeva Cousin, a senior euro-area economist at BE. The war’s shadow is dimming already muted salary pressures.

ECB policy makers including Executive Board member Isabel Schnabel have highlighted the “broad-based nature” of inflation that extends well beyond energy, fretting about the risks of reacting too late. Some also argue that wage growth doesn’t have to actually pick up, but rather just be visible, to demand action.

“The ECB’s credibility is at stake,” said Agnes Belaisch, chief European strategist at Baring Investment Services Limited. “They should stop singing the old song and be clear about what we’re facing. Inflation is accelerating and will continue to do so in the months ahead.”

Belaisch says the ECB should continue buying bonds under a “war-time envelope” to anchor long-term yields, while signaling its readiness to hike rates to tackle inflation.

Policy makers so far argue that asset purchases must stop before borrowing costs can rise, with net bond-buying under a pandemic program finishing this month. Economists see the ECB announcing in June that regular purchases will end in September, and then hiking rates toward year-end.

“There should at least be a case for closing quantitative easing as soon as possible, given that the ECB’s policies currently are adding to the inflation problem,” said Anatoli Annenkov, senior economist at Societe Generale. “However, I think it may be too early to send any hawkish messages already next week, as the implications of the war in Ukraine are still highly uncertain.”

©2022 Bloomberg L.P.