- XLM price is consolidating in a bullish pennant pattern, suggesting a massive 60% run-up soon.

- A decisive 6-hour candlestick close above $0.51 is necessary to break out from the bullish pennant.

- A bearish breakdown from the pennant could result in a downswing to the hourly 100 SMA at $0.41.

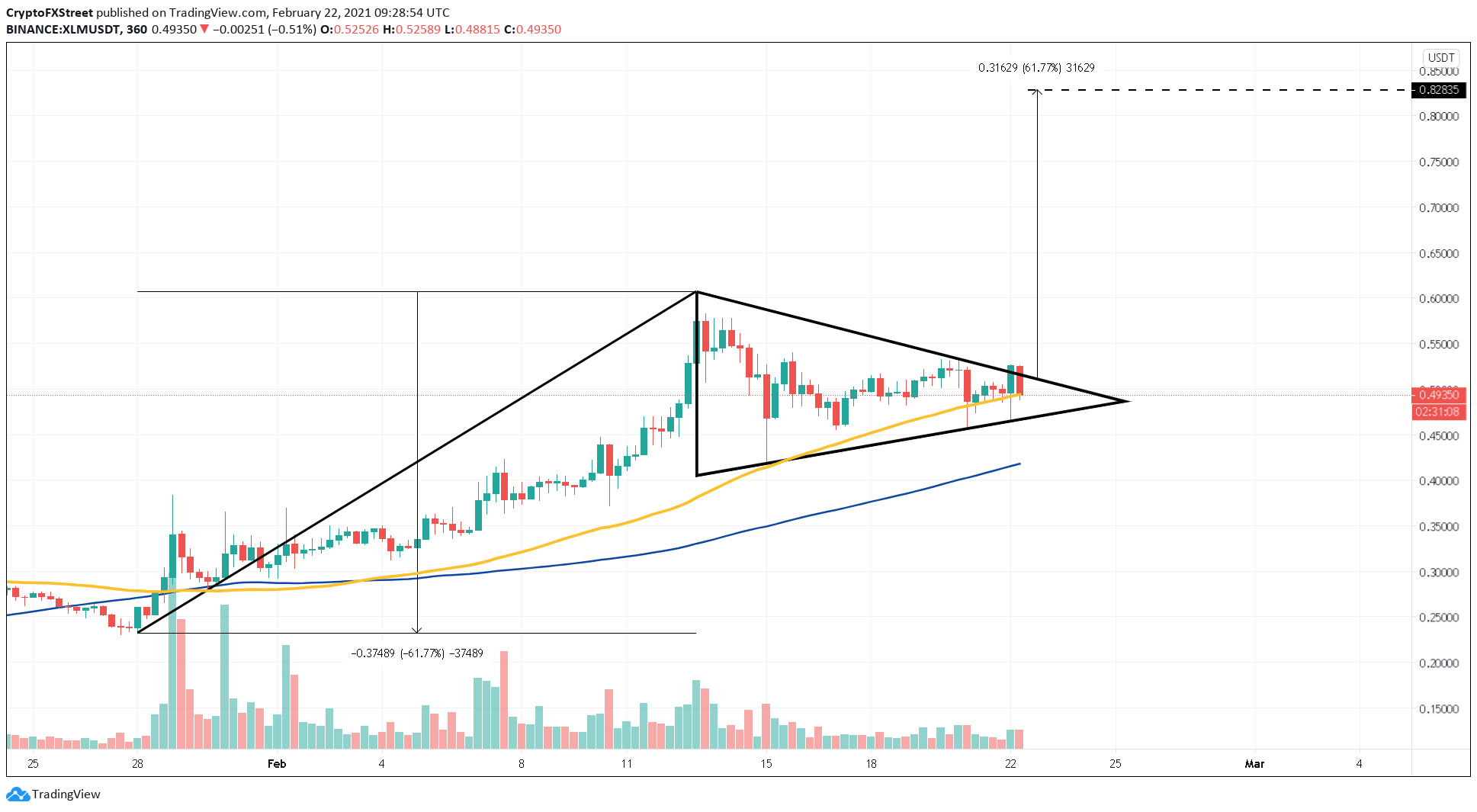

XLM price saw a 160% upswing between late January and mid-February to hit a new all-time high at $0.60. However, since hitting the record level, Stellar has slipped into a consolidation phase.

Depending on its close relative to a bullish pennant pattern drawn in the six-hour chart, XLM could either surge massively or drop to an immediate support barrier.

XLM price prepares for a higher high

XLM price shows a bullish bias due to the formation of a bullish pennant pattern. The 160% surge between January 28 and February 13 formed the “flag pole,” while the consolidation since then resulted in the “pennant.”

This continuation pattern forecasts a 60% upswing to $0.82, determined by measuring the flag pole’s length and adding to the breakout at $0.51.

Therefore, a six-hour candlestick close above $0.51 is imperative.

XLM/USDT 6-hour chart

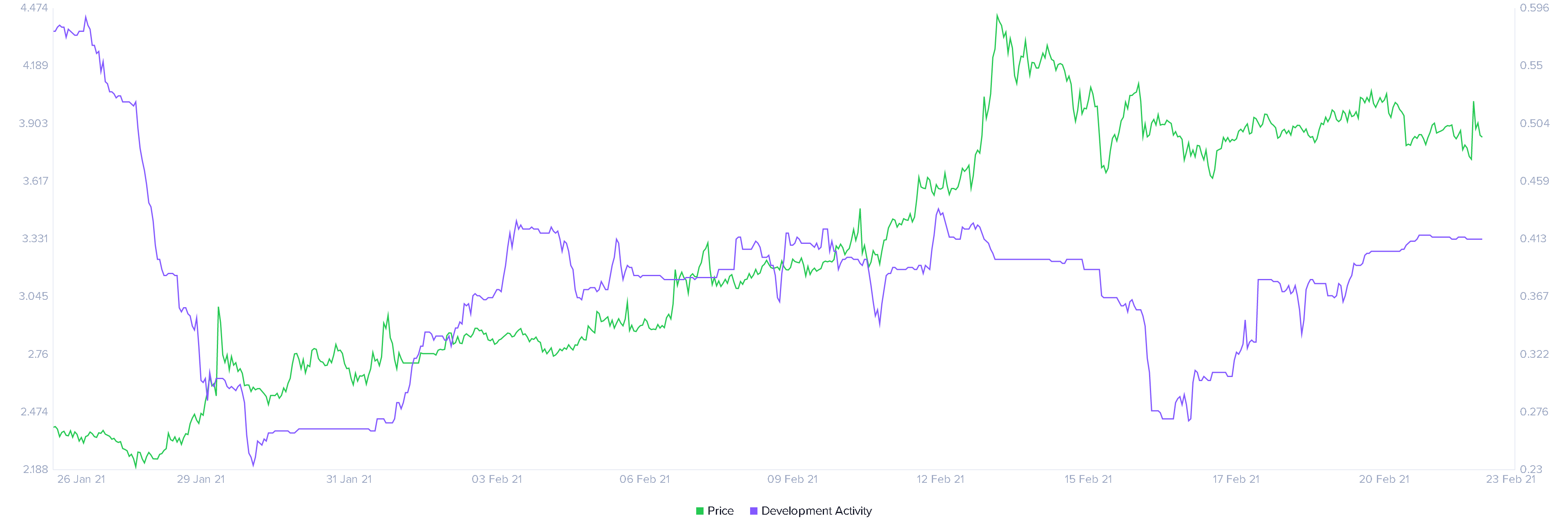

Adding credence to this bullish outlook is the increase in developer activity metric. This metric shows a 45% increase in the last six days while the price has remained relatively the same, suggesting that it might not be priced-in.

Usually, investors perceive a spike in this metric as bullish as it could mean a new update or developmental rollout for the project.

Stellar developer activity chart

On the other hand, a breakdown of Stellar price below the six-hour 50 moving average (MA) at $0.49 would be the first indication of mounting selling pressure. Moreover, a six-hour candlestick close below the pennant at $0.46 would invalidate the bullish outlook and suggest the dawn of a downtrend.

This resulting selling pressure would trigger a 10% correction up to the 100 six-hour MA at $0.41.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Cash gains slightly after Roger Ver's bail from Spanish prison

Bloomberg reports that a Spanish court granted Bitcoin Cash proponent Roger Ver bail. Roger Ver still faces extradition to the US for fraud tax evasion charges. Bitcoin Cash is up 2% since Ver's release.

High staking yield may prevent a Mantle sell-off

Over 91% of MNT is in profit following slight gains on Thursday. Most investors are still holding onto their tokens despite MNT setting several new all-time highs between March and April.

Ethereum ecosystem active users spike 55% in Q1, 2x ETH ETF records impressive volume

Volatility Shares 2x ETH ETF records over $15 million on second day of trading. Average daily Ethereum ecosystem users spike by more than 55% in Q1'24. Ethereum needs to overcome key resistance before any attempt to flip the yearly high of $4,093.

Meme coins foment clash among crypto experts amid growing interest from institutional investors

Crypto experts dispute value of celebrity meme coins following Iggy Azalea's reply to Buterin. Meme coin holdings among institutional investors have surged almost 300% since January. SHIB, DOGE, PEPE among top meme coin holdings held by institutional investors.

Bitcoin: BTC likely to provide another buying opportunity Premium

Bitcoin (BTC) price looks weak on the lower timeframes, which might provide opportunities to accumulate. The daily and weekly charts retain their bullish outlook and suggest that the continuation of the 2023 bull run is not a question of “if” but “when.”